In the dynamic world of financial technology, few companies have had as much of an impact on the stock market as Apple Inc. (AAPL). As a leader in the tech industry, Apple’s stock performance is a topic of great interest for investors, analysts, and financial news outlets alike.

Among the many sources providing insights into Apple’s stock, FintechZoom stands out for its in-depth analysis and accurate predictions.

In this article, we will delve into why Apple stock is such a hot topic in the FintechZoom world, explore its performance, factors influencing its value, and how it shapes the broader tech industry. We’ll also cover risks, challenges, and provide insights on how to invest in Apple stock via FintechZoom.

Why Apple Stock is a Hot Topic in FintechZoom

The Growing Popularity of Apple in Fintech

Apple’s influence on FintechZoom is undeniable. As one of the most valuable and recognized companies in the world, Apple plays a crucial role in the tech and stock markets. Investors and analysts track Apple’s movements closely because it impacts a wide range of sectors, from hardware to software and everything in between.

Apple has not only changed the way we interact with technology but has also created a massive ecosystem of products and services that keep expanding. Its ability to innovate and adapt to emerging trends, such as AI and machine learning, contributes to its increasing importance in the Fintech landscape.

Apple’s Market Position and Financial Growth

Apple’s market position is unparalleled. The company’s relentless focus on innovation and expanding its product line has led to continuous revenue growth. As of January 31, 2025, Apple’s stock price closed at $236.00, with an all-time high closing price of $259.02 recorded on December 26, 2024.

- Market Cap: Over $2.5 trillion, cementing Apple as one of the largest companies in the world.

- Revenue: In 2024, Apple generated a massive $391 billion in revenue, showcasing its financial strength.

- Net Income: A staggering $94 billion net income, further illustrating its financial health and profitability.

This financial power allows Apple to make significant investments in emerging technologies and keep up with global market demands. As a result, FintechZoom and other financial platforms closely monitor Apple for signs of growth or potential setbacks.

Understanding Apple Stock Performance

Historical Performance of Apple Stock

Apple’s stock has a storied history of performance, demonstrating a remarkable upward trajectory over the years. Since its initial public offering (IPO) in 1980, AAPL has undergone multiple stock splits and consistently shown growth, particularly since the early 2000s with the advent of the iPod, iPhone, and later the iPad.

Key milestones include:

- 2007: Launch of the iPhone, which dramatically increased Apple’s market share.

- 2011: After the death of co-founder Steve Jobs, Apple’s stock continued to soar under the leadership of Tim Cook.

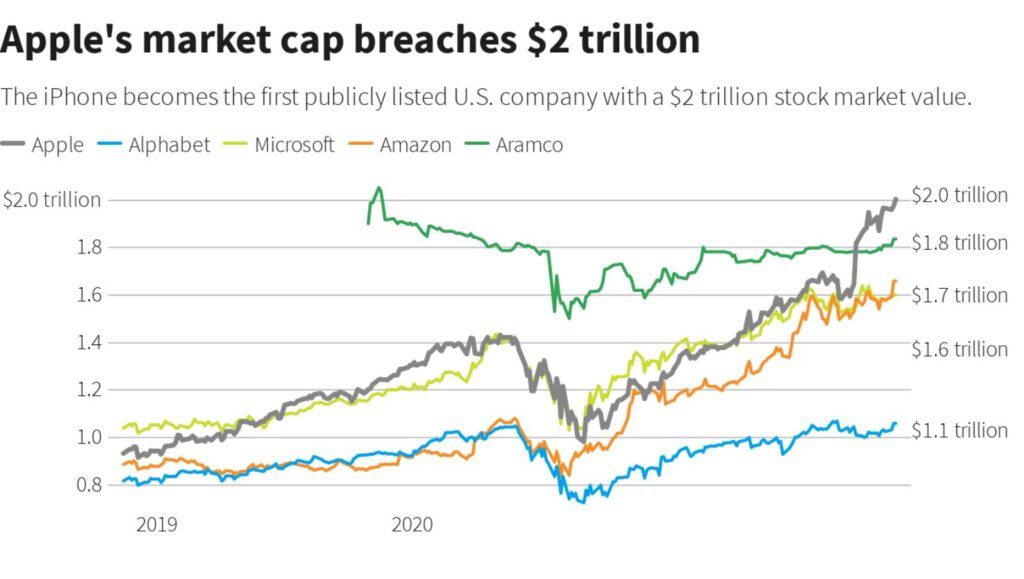

- 2020: Apple reached its $2 trillion market cap, marking another landmark in its stock performance.

Despite occasional fluctuations, Apple stock has shown a long-term bullish trend. Even during periods of market downturns or global crises, Apple’s stock has proven resilient, often bouncing back stronger than before.

Key Factors Influencing Apple’s Stock Price

Several factors play a role in the performance of Apple’s stock price:

- Innovation: New product launches, particularly in the smartphone, wearable tech, and computer markets, drive investor enthusiasm.

- Earnings Reports: Quarterly earnings reports that exceed or fall short of expectations can significantly move Apple’s stock.

- Market Conditions: Broader market movements, including global economic shifts, play a role in Apple’s stock performance.

- Investor Sentiment: Apple’s stock is widely regarded as a safe haven investment, with many institutional investors holding significant shares. Investor confidence impacts price action.

- Macroeconomic Factors: Interest rates, inflation, and geopolitical tensions—especially Apple’s reliance on China for manufacturing—also influence stock performance.

What Makes Apple a Strong Stock Investment?

Analyzing Apple’s Financials

One of the main reasons investors are drawn to Apple stock is its solid financials. The company has demonstrated consistent growth, which makes it a reliable investment.

- Revenue Growth: Apple’s diversified portfolio, from products like the iPhone to services such as the App Store and Apple Music, drives its growing revenue streams.

- Strong Cash Flow: Apple consistently generates significant cash flow, which it uses to reinvest in business operations, research and development, or return to shareholders through dividends and stock buybacks.

- High Profit Margins: Apple has one of the highest profit margins in the industry, ensuring strong returns on investment.

Competitive Edge and Innovation in Technology

Apple’s success is largely due to its innovation and competitive edge in technology. The company is known for its cutting-edge product design, user-friendly interfaces, and seamless ecosystem that keep consumers engaged across multiple devices.

Apple’s move into wearable technology, such as the Apple Watch, and its exploration of new realms like Augmented Reality (AR) further solidify its market dominance.

Apple is also making strides in the field of Artificial Intelligence (AI), with the development of Apple Intelligence, a new initiative aimed at integrating advanced AI into its products and services.

Read More Blog: Is Duolingo Plus Worth It in 2024?

Apple Stock Predictions and Forecasts

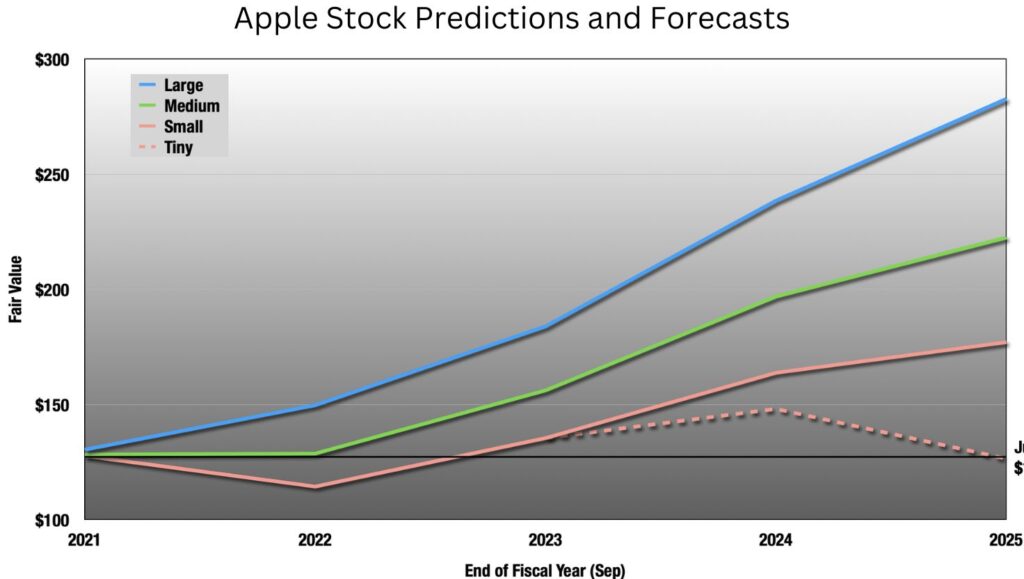

Expert Predictions for Apple Stock in 2024

Analysts are cautiously optimistic about Apple’s stock in the coming years. Despite global economic uncertainties, Apple’s continued financial health and product innovation position it well for future growth. For 2024, experts have set an average price target of $242.36, with predictions ranging between $180 to $325.

- Some analysts are bullish, citing potential growth in AI and wearable devices.

- Others are more cautious due to risks such as regulatory challenges and dependency on China.

Long-term Outlook and Investment Strategies

Looking ahead, Apple’s long-term outlook remains positive. With its strong financial position and leadership in innovation, it is expected to continue driving growth in the tech industry. For long-term investors, the following strategies may be relevant:

- Buy and hold: Apple’s history of strong growth suggests that long-term holding can yield profitable returns.

- Dollar-cost averaging: Consistently investing a fixed amount in Apple stock over time, regardless of short-term fluctuations, can reduce the impact of volatility.

FintechZoom Insights on Apple Stock

How FintechZoom Analyzes Apple Stock

FintechZoom is known for providing comprehensive analysis on various stocks, including Apple Inc. Their analysis focuses on several key areas, such as:

- Financial statements: FintechZoom evaluates Apple’s quarterly earnings and revenue projections.

- Market sentiment: The platform tracks investor sentiment and news that could influence stock price.

- Trend analysis: FintechZoom looks at long-term and short-term market trends, including technological advancements and product launches.

Notable Trends and Insights from FintechZoom’s Analysis

According to FintechZoom, some notable trends influencing Apple stock include:

- Artificial Intelligence: The integration of AI into Apple’s ecosystem is seen as a major growth opportunity.

- Service Growth: Apple’s increasing reliance on services (such as iCloud and Apple Music) offers a steady stream of recurring revenue, which could reduce dependence on hardware sales.

- Global Expansion: Apple continues to push its products and services into international markets, especially in emerging economies.

Apple Stock and Its Impact on the Tech Industry

Apple’s Role in Shaping the Tech Market

Apple has been at the forefront of shaping the tech market for decades. From the early days of the personal computer to its current dominance in the smartphone and wearable tech markets, Apple’s innovations have forced competitors to evolve and improve their offerings.

How Apple’s Stock Affects the Broader Market

Apple’s stock is often considered a market bellwether, influencing the broader tech sector. When Apple’s stock performs well, it often leads to positive movement across the entire tech industry. Conversely, when Apple’s stock faces a downturn, it can have a ripple effect on other tech companies’ stock prices.

Risks and Challenges for Apple Stock Investors

Potential Risks and Downturns in the Market

As with any investment, Apple stock is not without risks. Some of the key risks include:

- Regulatory scrutiny: Apple’s business practices, especially concerning app stores and user data, face increased scrutiny from regulators, particularly in the European Union.

- Market dependence: Apple’s reliance on China for manufacturing poses a risk, as any geopolitical or trade tensions could affect its operations and profits.

How to Mitigate Risks with Apple Stock

To mitigate risks when investing in Apple stock, investors can:

- Diversify their portfolios to reduce exposure to any single company.

- Stay informed by following FintechZoom’s updates on Apple’s performance and potential market changes.

- Consider risk management strategies such as stop-loss orders and option hedging.

How to Invest in Apple Stock via FintechZoom

Step-by-Step Guide to Investing in Apple Stock

Investing in Apple stock through FintechZoom is a relatively simple process. Here’s how:

- Sign up for an account on FintechZoom’s platform.

- Deposit funds into your trading account.

- Search for Apple Inc. (AAPL) on the platform.

- Choose your investment amount and decide whether you want to invest in Apple’s stock directly or through exchange-traded funds (ETFs).

- Place your order and monitor your investment through the platform’s tracking tools.

Tools and Resources from FintechZoom

FintechZoom offers a range of tools to help investors stay updated on Apple’s stock performance, including:

- Stock charts for tracking trends.

- Real-time news on market movements.

- Analyst ratings to guide investment decisions.

Read More Blog: How Long Will It Take You to Learn French on Duolingo?

Conclusion: Should You Buy Apple Stock?

Apple stock remains a strong investment for many due to its consistent growth, financial strength, and market leadership. While there are risks, such as regulatory challenges and global market fluctuations, Apple’s innovative products, financial resilience, and leadership in emerging technologies provide a solid foundation for future growth.

Should you buy Apple stock? If you’re looking for a stable and reliable investment in the tech industry, Apple remains a compelling choice for long-term investors.

Welcome to Brieghtsvision.Com!

Your one-stop place for tips and guides to get the most out of Duolingo. Make learning a new language easier with helpful content for learners of all levels.